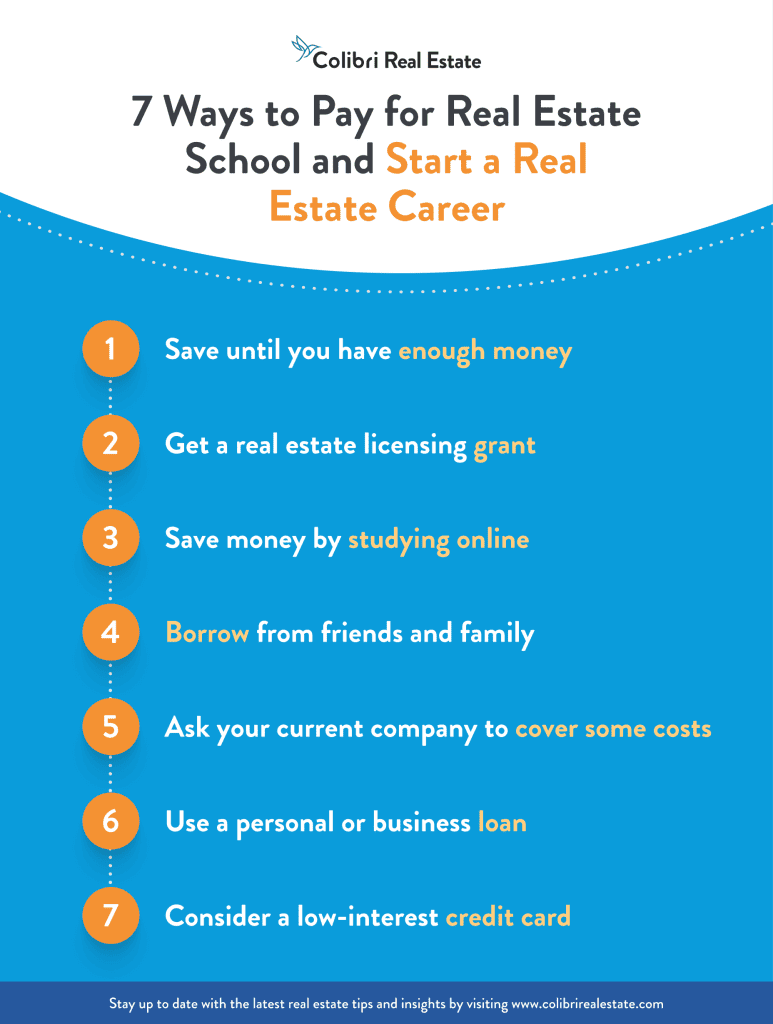

Getting started in real estate can be daunting, but knowing how to afford real estate start-up costs is a crucial first step. Before you can establish yourself as a real estate professional, you need to figure out the expenses involved, including the cost of getting licensed.

Fortunately, there are different ways to afford these start-up costs, each with advantages and disadvantages. To make the right decision for your career, it’s important to carefully consider the costs associated with launching your real estate business. Here’s a look at 7 different ways to plan and prepare to afford the start of your dream career.

Save until you have enough money

Starting your own real estate business can be financially daunting, but there’s a way to begin without borrowing any cash. Consider cutting expenses while finding opportunities to increase earnings. Here are some suggestions:

- Clear out your home and sell unused items for extra income through traditional garage sales or online sites like ThredUp.

- Create a budget and stay on track by using apps like Mint that track expenses.

- Convert unused gift cards to cash through gift card conversion sites and add those funds to your savings.

- Ask loved ones to support your startup dreams by giving cash instead of presents during holidays.

- Earn extra cash through temporary side gigs like ridesharing, renting out an extra room on Airbnb, or offering handyman services through sites like Handy or TaskRabbit. Food delivery jobs through Postmates or Instacart are also worth considering.

Get a real estate licensing grant

Looking for real estate education grants can be quite challenging, especially if you’re not pursuing a degree in this field. But don’t give up just yet – there are options available to help you. Instead of general grants and scholarships, your best bet may be to search for local real estate associations that offer financial assistance to aspiring agents. This can give you the boost you need to get started in the industry.

Borrow from friends and family

If you’re looking to finance your real estate start-up, borrowing from loved ones is an option. However, be cautious as it could harm your relationships if the repayment goes sideways. To avoid this possibility, set up a payment plan and make timely payments. Though they may trust you, creating a formal repayment structure can strengthen your bonds and ensure lasting relationships.

Ask your current company to cover some costs

Did you know that if your current job involves real estate, your employer might be willing to cover some or all of the costs of your education? Many individuals pursue real estate as a side gig while holding down a full-time job. With dedication and hard work, they eventually transition into full-time real estate when their business has grown enough to support them.

Save money by studying online

Save money and time by taking an online pre-licensing course instead of an in-person one. In-person courses come with extra expenses like parking and materials, but online courses let you learn from the comfort of your own home without any additional costs. Don’t break the bank for the same education – go digital with your learning.

Use a personal or business loan

To secure start-up costs for a career in real estate, consider applying for a personal or business loan. Your credit score will impact the amount you qualify for and the interest rate you’re charged. With online lenders like Earnest, SoFi, and LendingClub, you can compare rates through a soft credit check and potentially find better options than traditional lenders. Just be sure to have a solid repayment plan in place before signing any loan agreements to avoid damaging your credit score.

Consider a low-interest credit card

If you’re short on cash and need to cover some extra expenses, consider using a credit card. Look for one with a 0% APR introductory rate – this means you won’t have to pay any interest on your purchases, if you pay off the balance before the rate changes. However, be careful not to carry a balance beyond the introductory period – you could end up with a high interest rate. This approach is ideal if you’re still earning money and just need temporary financial support.

Partner with Colibri Real Estate to start your real estate career

Colibri Real Estate offers multiple ways to learn, including instructor-led livestream classes or self-paced online courses. To further help with real estate start-up costs, we offer a pass or don’t pay guarantee. This means we guarantee you’ll pass your exam on the first try with our industry-leading exam prep. And if you don’t? We’ll reimburse the original cost of your pre-licensing package.