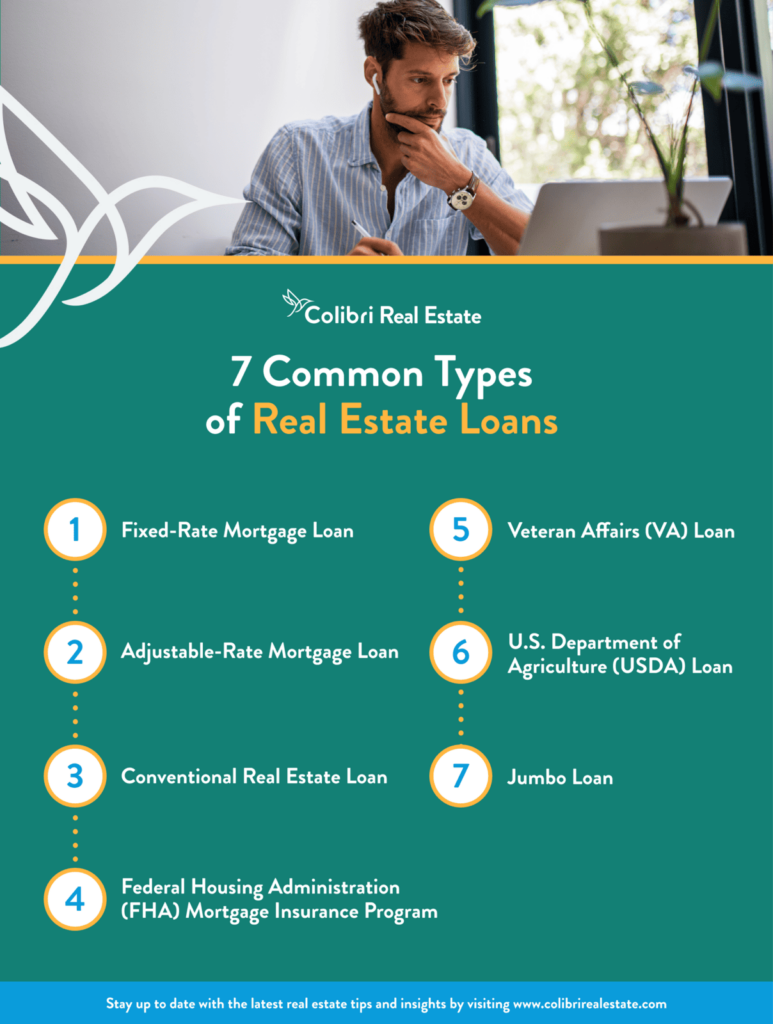

To be a truly outstanding real estate agent, you need to be a source of information for your clients. That means being able to advise them on everything about the home-buying process- including different loan options that are available to them. Understanding common types of real estate loans empowers you to guide your clients toward the financing solution that best suits their needs and goals.

Types of Home Loans

Knowing the different types of loans can be vital in helping potential homeowners achieve their dreams. Let’s examine seven common types of real estate loans and discuss how they can benefit home buyers and sellers alike. Having a firm grasp on the various loan products available is essential for success in real estate.

1. Fixed-Rate Mortgage Loan

A fixed-rate mortgage loan is a type of home loan in which the interest rate remains constant throughout the entire repayment term. This means that a borrower’s monthly mortgage payments will remain the same over the life of the loan – unless there are changes in homeowners insurance premiums or property tax rates. This type of loan provides predictability and stability.

One of the key advantages of a fixed-rate mortgage is that it shields borrowers from potential interest rate fluctuations. Even if interest rates rise significantly in the future, the borrower’s interest rate and monthly payment will remain unchanged. This stability makes it easier for home buyers to budget and plan their finances over the long term.

Fixed-rate mortgage loans are typically offered with repayment terms of 15, 20, or 30 years, although other term lengths may be available. The longer the term, the lower the monthly payments, but the total interest paid over the life of the loan will be higher. Conversely, shorter-term loans have higher monthly payments but result in less interest paid overall.

Fixed-Rate Mortgage Loan Pros

- Predictability: With a fixed interest rate, borrowers can plan their budget confidently, knowing their monthly payments won’t change.

- Protection from market fluctuations: Regardless of how interest rates fluctuate, the borrower’s rate remains unchanged, offering stability.

Fixed-Rate Mortgage Loan Cons

- Potential for higher interest rates: Fixed-rate mortgages may have higher initial interest rates than adjustable-rate mortgages during their introductory period.

- More cost prohibitive: Monthly payments may be higher initially than adjustable-rate mortgages, potentially limiting affordability for some buyers.

2. Adjustable-Rate Mortgage Loan

An adjustable-rate mortgage loan, often called an ARM, is a type of home loan where the interest rate is not fixed and can fluctuate based on market interest rates. Unlike a fixed-rate mortgage, the interest rate on an ARM can move up and down during the repayment term.

ARMs typically have an initial fixed-rate period, during which the interest rate remains constant for a specified period, ranging from 3-10 years. The rate during this period is generally lower than the rates offered for fixed-rate mortgages. After the initial fixed-rate period expires, the interest rate on an ARM will adjust yearly.

The advantage of an ARM is that during the initial fixed-rate period, borrowers can enjoy lower monthly mortgage payments compared to a fixed-rate mortgage. This can be particularly appealing to first-time homebuyers or individuals with budget constraints who are looking for more affordable options in the early years of homeownership. However, interest rates on an ARM are subject to change. If market interest rates rise, borrowers may experience an increase in their monthly mortgage payment, which can pose financial challenges for homeowners if they have a tight budget or are unprepared for potential rate increases.

Adjustable-Rate Mortgage Loan Pros

- Lower initial rates: Borrowers benefit from lower initial monthly payments during the fixed-rate period, making homeownership more affordable in the early years.

- Potential for lower rates: If market interest rates decrease, borrowers could experience reduced monthly payments during the adjustable phase.

Adjustable Rate Mortgage Loan Cons

- Rate volatility: Just as interest rates have the potential to decrease, they also have the potential to increase. If market rates rise, borrowers may face higher monthly payments, impacting affordability and financial stability.

3. Conventional Real Estate Loan

A conventional mortgage loan is not insured or guaranteed by any government agency. Instead, it is typically offered by banks and private lenders. Conventional loans are ideal for borrowers with good or excellent credit and debt-to-income ratio, as their creditworthiness plays a significant role in loan approval.

Conventional loans have stricter qualification criteria than government-backed loans, and buyers will need excellent credit to receive the best interest rates.

One of the primary advantages of a conventional loan is its flexibility. While government-backed loans often have specific eligibility requirements and restrictions, conventional loans offer more options and fewer limitations. Borrowers can use conventional loans to finance various types of properties, including primary residences, second homes, and investment properties.

Conventional Real Estate Loan Pros

- Flexibility: Conventional loans offer more flexibility regarding property types and financing options than government-backed loans.

- Lower down payment options: Well-qualified buyers can access conventional loans with down payments as low as 3%, expanding homeownership opportunities.

Conventional Real Estate Loan Cons

- Stricter qualification criteria: Buyers need excellent credit and a good debt-to-income ratio, or DTI, to qualify for the best interest rates and terms.

- No government backing: Conventional loans lack the backing of government agencies, potentially limiting access for some buyers.

4. Federal Housing Administration (FHA) Mortgage Insurance Program

FHA loans are insured by the Federal Housing Administration, which operates within the Department of Housing and Urban Development (HUD). Borrowers with FHA loans pay for mortgage insurance, which protects the lender in the event of borrower default. This insurance increases the borrower’s monthly payments, and the lender must be FHA-approved to qualify.

While it’s commonly thought that FHA loans are only for first-time buyers, FHA loans are actually available to many buyers. They are popular due to their low down payment requirement, often as little as 3.5 percent of the home price. Additionally, FHA loans have more lenient lending standards than conventional loans. However, borrowers must have a minimum credit score of 580 to qualify. Borrowers with a lower credit score of at least 500 may still be eligible for an FHA loan with a down payment of 10 percent of the home price.

Overall, FHA loans provide an excellent option for buyers who may not qualify for conventional loans or have limited funds for a down payment. The low down payment requirement and more lenient lending standards make homeownership more achievable for a broader range of individuals and families.

FHA Loan Pros

- Low down payment requirement: FHA loans offer down payments as low as 3.5%, making homeownership more accessible to buyers with limited funds.

- Lenient lending standards: FHA loans have more flexible credit requirements than conventional loans, accommodating buyers with lower credit scores.

FHA Loan Cons

- Mortgage insurance premiums: FHA borrowers must pay mortgage insurance premiums, increasing monthly payments and overall loan costs.

- Minimum credit score requirements: While FHA loans have lenient credit standards, borrowers still need to meet minimum credit score requirements to qualify: 580 for a 3.5% down payment and 500 for a 10% down payment.

5. Veterans Affairs (VA) Loan

VA loans are exclusively offered to military service members and their families and are backed by the U.S. Department of Veterans Affairs. Should the borrower default on the loan, the VA reimburses the lender for any losses.

To qualify for a VA loan, borrowers must meet specific criteria. This includes having suitable credit, demonstrating sufficient income to afford the loan payments, and obtaining a valid Certificate of Eligibility (COE). The COE is a document that verifies the borrower’s eligibility for the VA loan benefit. Meeting specific service requirements, which can vary depending on the length and nature of the borrower’s military service, obtains it. Generally, the borrower must have served for a minimum period of time and must not have received a dishonorable discharge.

One of the significant advantages of VA loans is the option for 100 percent financing. Eligible borrowers can finance the entire purchase price of the home without the need for a down payment. This feature sets VA loans apart from other types of mortgages. It can be especially beneficial for borrowers with difficulty saving for a down payment or prefer to allocate their funds toward other expenses.

In addition to 100-percent financing, VA loans offer several other benefits. These include competitive interest rates, no private mortgage insurance (PMI) requirement, and the ability to negotiate with sellers to pay certain closing costs. VA loans also provide flexibility in terms of property types.

Veterans Affairs Loan Pros

- No down payment: Eligible borrowers can secure VA loans with no down payment, reducing upfront costs and barriers to becoming homeowners.

- Competitive interest rates: VA loans offer competitive interest rates compared to conventional loans, saving borrowers money over the loan term.

Veterans Affairs Loan Cons

- Eligibility requirements: To qualify for VA loans, borrowers must meet specific criteria, including service length and type.

- Funding fee: VA loans may require a funding fee, adding to upfront costs (although this fee can often be rolled into the loan amount).

6. U.S. Department of Agriculture (USDA) Loan

The USDA provides a loan program through the Rural Housing Service (RHS). This program aims to assist rural borrowers with modest incomes who may face challenges securing affordable housing through conventional financing options.

To qualify for a USDA loan, borrowers must meet specific income requirements. Borrowers’ income should not exceed 115% of the adjusted area median income in the county where they intend to purchase a property.

In addition to income limits, USDA loans require the property to be located in an eligible rural area. The USDA defines rural areas based on population size and density. The exact boundaries of eligible areas may change over time. They generally include small towns, rural communities, and some suburban areas that meet the criteria set by the USDA.

It’s important to note that USDA loans serve as a form of homeownership assistance and can only be used for primary residences. These loans are an excellent option for individuals and families in rural areas who may not qualify for conventional financing due to income limitations or lack of available down payment funds.

USDA Loan Pros

- Rural homeownership assistance: USDA loans help rural borrowers access affordable housing with low-income requirements and no down payment.

USDA Loan Cons

- Primary residence only: USDA loans only support primary residence purchases. While this provides stable housing options for rural families, those seeking a second property cannot utilize this loan type.

- Location restrictions: Properties must be located in eligible rural areas, potentially limiting housing options for borrowers.

- Income limits: Borrowers must meet income limitations, restricting eligibility based on financial status.

7. Jumbo Loan

A jumbo mortgage loan exceeds the conforming loan limits set by Fannie Mae and Freddie Mac, the government-sponsored enterprises. These loans are typically used for high-priced properties and require larger down payments and higher credit scores. Jumbo loans often have slightly higher interest rates due to their higher-risk nature.

One of the defining characteristics of jumbo loans is their higher loan amount. Since they exceed the conforming loan limits, jumbo loans enable borrowers to finance luxury real estate, high-end properties, or homes in expensive real estate markets. The specific loan limit for jumbo loans varies by region, and borrowers must consult local loan limit guidelines to determine if their loan amount falls into the jumbo loan category.

Jumbo Loan Pros

- High-value property financing: Jumbo loans allow borrowers to finance luxury properties or homes in expensive real estate markets beyond the limits of conventional loans.

- Customizable terms: Borrowers can negotiate customized terms with lenders to suit their financial needs and goals, offering flexibility in their loan structure.

Jumbo Loan Cons

- Higher down payment: Jumbo loans often require larger down payments than other loan types, increasing upfront costs for borrowers.

- Higher interest rates: Due to their higher loan amounts and increased risk, jumbo loans may carry higher interest rates, leading to higher overall borrowing costs.

Spend some time brushing up on the common types of real estate loans available to your clients. That way, you’ll be able to answer their questions when they ask you about different home loan types. By investing in your real estate education, you will provide exceptional service and support to your clients throughout their home-buying journey.

Interested in pursuing a real estate career? Earn your real estate license online with Colibri Real Estate School. Need help preparing for your state licensing exam? Register for our Real Estate Exam prep course. Contact us today to learn more and get started.